Enterprise Performance Management (EPM)

What

is enterprise performance management?

Enterprise

Performance Management (EPM) software helps you analyze, understand, and report

on your business. EPM refers to the processes designed to help

organizations plan, budget, forecast, and report on

business performance as well as consolidate and finalize financial results (often

referred to as “closing the books”). EPM solutions are primarily used by CFOs

and the office of finance, while other functional areas, such as HR,

sales, marketing, and IT, use EPM for operational planning, budgeting, and

reporting.

The

EPM cycle

While

often tied to enterprise resource planning Enterprise Resource Planning systems,

EPM software complements ERP by providing management insights in addition to

top of operational data. In other words, ERP is about operating the

business—the day-to-day transactional activity—and EPM is about managing the

business—analyzing, understanding, and reporting on the business.

Today,

EPM software is considered to be critical for managing all types of

organizations by linking financial and operational metrics to insights—and

ultimately driving strategies, plans, and execution. With EPM software,

managers can drive improved performance across the organization by monitoring

financial and operational results against forecasts and goals and using

analytics to recognize key trends and predict outcomes.

In

an environment of constant change, new competitors, and economic uncertainty,

EPM offers a tool for organizations to manage their agile businesses. With

finance at the helm, EPM business processes (strategic modeling,

plan, consolidate and close, report, and analyze performance) can help

organizations understand their data and use it to make better business decisions.

Business

value of EPM software—critical in uncertain times

The

key to surviving disruption is flexibility. Whether the disruption comes from

outside forces (such as new regulations or global weather events) or market

realities (one product skyrockets to success while another flops),

organizations that respond quickly are able to stay ahead of the curve. A

modern EPM solution enables you to understand how, when, and where to adjust to

disruptions.

Optimize

the financial close In a changing regulatory environment, you need to adapt

quickly to new requirements and deliver faster, more accurate insights to all

stakeholders. EPM helps you streamline the financial close and report with

confidence and insight.

Streamline

account reconciliation Account reconciliation is the number one reason for

non-data-related delays in the financial close. EPM enables you to efficiently

manage and improve global account reconciliation by exploiting automation and

comprehensively addressing the security and risk typically associated with this

process.

Drive

accurate and agile integrated plans—The digital economy demands more than

spreadsheets and department-oriented planning processes. Truly effective

planning should seamlessly connect your entire organization for a better vision.

With EPM you can align planning across the enterprise, so that you can develop

agile forecasts for all lines of business and respond faster and more

effectively to change.

Manage

and drive profitability—To survive in uncertain times, you must be able to

manage and drive profitability. EPM helps you gain insight into dimensions of

cost and profitability to determine where to invest limited resources.

Align

tax reporting with corporate financial reporting—Changing tax laws are causing

global organizations to plan and manage their tax affairs very differently than

they have to-date. EPM supports effective tax reporting by connecting the

processes, data, and metadata that tax and finance share, such as financial

planning, financial close, and regulatory reporting.

Satisfy

all your reporting requirements—No matter how many reporting standards you have

to comply with, you want to be sure that the data you provide in your reports

is accurate, complete, and the most current information available. EPM reduces

the need for multiple reporting systems.

Manage

change with enterprise data management—Whether you're migrating applications to

the cloud, managing applications in a hybrid environment, or spearheading major

business and financial transformation, an enterprise data management

platform provides data accuracy and integrity with the alignment of your

data and master data.

Next-generation

EPM—analysis to action

Historically,

EPM systems have focused on transitioning finance from spreadsheets to more

robust solutions that let teams spend less time on low-value tasks such as data

manipulation and reconciliations and more time on high-value tasks like

analysis. But even after making the move from spreadsheets, there’s still too

much time between analysis and action.

Enter

the next generation of EPM, which has new capabilities that incorporate

emerging technologies, such as artificial intelligence and machine learning.

These technologies are powerful decision-making tools because they close the

gap between analysis and action. They help improve the quality of decisions

made by finance managers and executives by detecting hidden patterns and

insights in historic data. The impact on decision-making is widespread, from

tactical (which vendor to pay first) to operational (budget reallocations) to

strategic (mergers and acquisitions).

Beyond

decision-making, these technologies can automate routine tasks to eliminate

manual labor and reduce the likelihood of errors. There are many tasks in the

financial close and reconciliation process that fall into this category. This

type of automation will free up valuable time for finance professionals to

engage with operations and spend more time providing the forward-looking

guidance that management needs to capitalize on the next opportunity.

Enterprise

Performance Management (EPM) is the process of monitoring performance

across the enterprise with the goal of improving business performance. An EPM

system integrates and analyzes data from many sources, including, but not

limited to, e-commerce systems, front-office and back-office applications, data

warehouses and external data sources. Advanced EPM systems can support many

performance methodologies such as the balanced scorecard.

History

of EPM

The

concept of EPM has been around for decades. Before computers, EPM processes and

solutions were managed manually via meetings, phone calls, and discussions. In

the 1970s, the first EPM software applications became available and accounting

solutions began collecting budgeting and financial information for reporting

purposes. Spreadsheets were introduced in the 1980s with software such as

Lotus1-2-3 and VisiCalc. Spreadsheets allowed finance teams to automate budget

and report creation and replace manual worksheets. The availability of email in

the 1990s allowed people to share spreadsheets, which led to better

collaboration and collection of budgeting and reporting data. Around the same

time, the first EPM software packages began to automate the financial

consolidation and reporting process. These products included: IMRS Micro

Control (which later became Hyperion software), Hyperion Enterprise for

financial consolidation and reporting, and Hyperion Pillar for planning

processes.

EPM

today—from

on-premises to the cloud

Over

the past couple of decades, EPM software platforms evolved from Windows-based

client/server systems to internet-enabled, web browser-based applications.

Today, there’s an increasing demand for cloud-based EPM software, also known as

software as a service (SaaS). When EPM software is “in the cloud” it simply

means that the application is housed on a network of remote servers, instead of

at a company’s location.

The

cloud offers a more affordable alternative for EPM that lowers both operational

expenses and capital expenses, because it eliminates the need for companies to

purchase software and hardware or hire additional IT staff. With no costly

infrastructure to support, resources can be invested in growth opportunities,

while employees can focus on more value-added tasks instead of managing IT.

Next-generation

EPM—analysis

to action

Historically,

EPM systems have focused on transitioning finance from spreadsheets to more

robust solutions that let teams spend less time on low-value tasks such as data

manipulation and reconciliations and more time on high-value tasks like

analysis. But even after making the move from spreadsheets, there’s still too

much time between analysis and action.

Enter

the next generation of EPM, which has new capabilities that incorporate

emerging technologies, such as artificial intelligence and machine learning.

These technologies are powerful decision-making tools because they close the

gap between analysis and action. They help improve the quality of decisions

made by finance managers and executives by detecting hidden patterns and

insights in historic data. The impact on decision-making is widespread, from

tactical (which vendor to pay first) to operational (budget reallocations) to

strategic (mergers and acquisitions).

Beyond

decision-making, these technologies can automate routine tasks to eliminate

manual labor and reduce the likelihood of errors. There are many tasks in the

financial close and reconciliation process that fall into this category. This

type of automation will free up valuable time for finance professionals to

engage with operations and spend more time providing the forward-looking

guidance that management needs to capitalize on the next opportunity.

What is Enterprise Performance

Management (EPM)?

Enterprise

Performance Management, more commonly referred to as EPM, is a type of business

planning used by a wide range of entities that involves the evaluation and

management of an enterprise’s performance and ability to reach goals, increase

efficiency, and maximize business processes. EPM drives the improved

performance of an enterprise by comparing its results to its forecasts and

goals.

The

concept of EPM has existed for decades, spanning back to the Industrial

Revolution as businesses then sought to automate processes to maximize their efficiency

and increase their bottom line. In the 1970s the first rudimentary EPM software

was implemented, paving the way to where we are now. EPM in the present makes

the most out of today’s technology through the use of on-premises and cloud

software systems to aggregate and analyze data.

EPM

business processes

The

business processes associated with EPM can be broken down into five functional

areas: Strategic modeling, planning and budgeting, close and

consolidation, reporting, and performance analytics. Read on for an overview of

each of these areas.

Strategic

modeling

Strategic

modeling allows users the opportunity to develop long-range strategic forecast

models. It is useful for detailed forecasting and analysis of trends and frees

up time spent on manually gathering data. Strategic modeling gives users a

sense of confidence in the accuracy of their projections, reports, and audits.

Planning

and budgeting

Using

EPM software for planning and budgeting gives users flexibility and

scalability with their forecasts. While standard EPM products include

out-of-the-box planning content, others, such as Oracle EPM, go a step

further and provide the user with the ability to create custom parameters for

future planning and budgeting.

Close

and consolidation

EPM

software can be used for streamlining financial close and consolidation, making

it easy for users to report on their business with confidence. This support

gives users peace of mind when it comes to meeting global regulatory

requirements and provides the requisite transparency of data for

stakeholders both internal and external.

Reporting

Financial

reporting has been revolutionized by EPM software. It provides a format for

neat, consistent, standardized reporting. EPM software can be used to

consolidate briefs into executive reports, distribute report content to

stakeholders, and integrate financial decisions, among other functionalities.

Performance

analytics

Analyzing

past performance is made easier and more accurate than ever before with EPM

technology. EPM technology is used to conveniently analyze trends across years,

divisions, and against planned performance. This data creates a holistic

picture of the enterprise that is invaluable for leadership, management, and

stakeholders.

Why

do we need EPM?

With

EPM you can align planning across the enterprise, so that you can develop

agile forecasts for all lines of business and respond faster and more

effectively to change. Manage and drive profitability—To survive in uncertain

times, you must be able to manage and drive profitability.

What

are the components of EPM?

Some

of the key components of EPM systems include planning, budgeting, and

forecasting capabilities and the ability to monitor KPIs, provide analysis, and

manage reporting.

Effective

enterprise performance management (EPM) is the key to business success. Having

a great business strategy is only the first step to growing a sustainable

business. You also need clearly defined objectives and effective processes that

provide structure and direction in achieving those goals. But, perhaps

even more importantly, you need a system for tracking.

Effective

enterprise performance management (EPM) is the key to business success.

Having

a great business strategy is only the first step to growing a sustainable

business. You also need clearly defined objectives and effective processes that

provide structure and direction in achieving those goals.

But,

perhaps even more importantly, you need a system for tracking and measuring

performance so you can continue to improve performance.

To

paraphrase management guru Peter Drucker, you can’t manage what you don’t

measure.

A

big challenge for any business is balancing the long-term strategic priorities

of the business with short-term operational priorities. Failing to balance strategic

and operational needs leads to organizations underperforming.

If

too much focus is given to immediate operational concerns, strategic objectives

fall by the wayside. Similarly, if all the focus is on the big goals, critical

operational issues often aren’t recognized and addressed in time. This can

result in delays, under-resourcing, and high employee turnover.

This

balancing act is part of the job for execs and managers. It’s made easier with

the right management system.

In

this article, we’ll explore how an enterprise performance management system

enables managers to translate strategic priorities into operational actions and

to measure—and improve—the effectiveness of both.

Enterprise

performance management (EPM) refers to the systems and processes involved in

setting strategic business goals, translating these goals into measurable

objectives, planning operations and allocating resources, and tracking

enterprise performance against these goals.

EPM

involves actively collecting and analyzing data to report on past performance,

forecast future success and failure scenarios, and plan and implement strategic

interventions to continuously improve performance.

On

a strategic level, EPM is the domain of decision-making executives—CFOs in

particular. It is used for operational planning, budgeting, and KPI tracking

and reporting by units or departments throughout the organization. This

includes human resources, I.T., product, marketing, sales, customer service,

and finance teams.

Enterprise

performance management is also sometimes referred to as business performance

management (BPM), corporate performance management (CPM), and financial

planning and analysis (FP&A).

EPM

vs enterprise resource planning (ERP)

While

EPM is often in conjunction with ERP, they are not interchangeable.

ERP,

enabled through ERP systems, covers the day-to-day transactional

activities involved in managing operations. EPM analysis goes beyond

operational data to provide an extra layer of managerial insights to help

inform strategy decisions.

Benefits

of enterprise performance management

At

its core, the function of enterprise performance management is to improve

organizational efficiency by balancing high-level business strategy with

operational performance.

This

clarity of purpose offers employees throughout the organization increased

stability and a greater sense of direction and unity—which in turn translates

into better strategic alignment across departments.

Improved

business intelligence

By

setting clear goals and actively tracking performance against key performance

indicators (KPIs) across the organization, managers and teams have a cohesive

view of the current status of the business.

This

data empowers management to run projections, identify opportunities and

threats, and make informed decisions to improve efficiency and profitability.

Improved

profitability

By

continuously monitoring the business’s financial performance and tracking

margins, EPM can help business leaders to predict the profitability of future

initiatives and scenarios.

This

enables them to adjust their strategy to take advantage of opportunities and

avoid pitfalls, removing inefficiencies and maximizing returns.

Greater

regulatory oversight and compliance

Accurate,

real-time data from touch points throughout the business makes it easier to

ensure regulatory compliance.

Many

modern EPM systems offer features that assist companies to generate detailed

reports. This makes financial close easier by automating corporate financial

reporting and tax reporting.

Streamlined

financial processes

By

promoting detailed expenditure projections, EPM facilitates better financial

planning and analysis, resulting in more accurate budgets.

With

process automation and continuous tracking, EPM streamlines financial consolidation

by removing a lot of the time-consuming admin. It also reduces errors from the

process of reconciling the books for financial close.

The

enterprise performance management process

Here’s

how the EPM process typically looks:

1.

Consult data from all business units

Detailed,

up-to-date data enables businesses to make strategic planning decisions based

on past performance and informed projections. The more of your business

processes that are digitized and automated, the easier it will be to consolidate

this data. EPM software with decent data analytics capabilities will help you

create realistic forecasting models based on past performance data.

2.

Develop a strategy

After

analyzing the data, identify new strategic performance goals that will improve

the organization’s performance and profitability. The more specific you can be

about the desired outcomes and the actions needed to achieve them, the better.

Create clear objectives and define metrics or KPIs with which to track

them.

3.

Budget and resource

Create

a detailed plan (with some flexibility built-in) describing the capital and

resources required to execute the initiatives described in your strategy. Once

again, data from previous years will help inform this process. However, be sure

to consult key unit stakeholders to collaboratively establish accurate costing

estimates, especially for new (previously unseen) projects.

4.

Execute, track, and report

Continuously

track performance across all units of your organization using pre-defined

metrics that measure whether initiatives are in alignment with the company’s

strategic goals. Prepare scorecards and reports that make it easy to identify

successes, shortfalls, bottlenecks, and other key information that can help

determine whether strategy or workflow adjustments are needed. Explore our

comprehensive guide on performance review phrases to enhance your feedback

sessions.

Analyze

and assess

Review

your reports to see how well the company’s performance aligned with its

strategic goals. Identify opportunities for improvement and investigate the

root causes of underperforming areas. Use this business intelligence to drive

and inform your strategy for the next cycle.

Enterprise

performance management is an iterative process, meaning it is likely to take a few

cycles to get it right.

One

of the common pitfalls many companies fall into is failing to translate their

ambitious goals into specific targets and actions that managers can understand,

execute, and measure effectively.

To

help with this, Liz Lockhart’s article on cascading goals is a great

place to start.

If

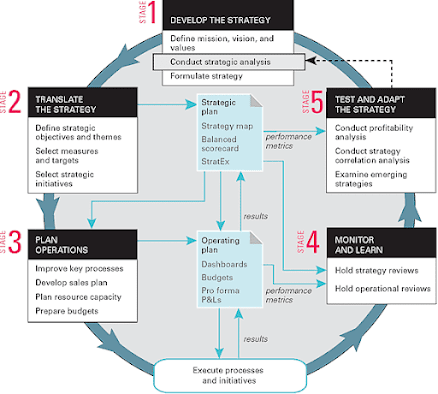

you’d like to dive into enterprise performance management in more detail, have

a look at the closed-loop management system developed by Robert S.

Kaplan and David P. Norton.

Published

in HBR in 2008, it’s slightly dated now (i.e. it doesn’t take into

account the data analytics capabilities of the software available today), but

it’s still a compelling read and the strategic insights it contains are

solid.

How

do you manage business performance?

Businesses

across all industries benefit from implementing proper enterprise performance

management. Of course, needs will vary and organizations will enter at

different starting points.

Business

leaders today have the distinct advantage of technologies that use machine

learning help to automate much of the heavy lifting when it comes to reporting,

data analysis, and forecasting.

It’s

just a matter of selecting the right EPM solution for the job.

To

see what options are available, and choose the right solution for your

business, check out our pick of the best enterprise performance management

software on the market today.

What

is the difference between management controls and operational controls?

Strategic

control involves monitoring and adjusting an organization's overall

strategy to ensure that it is aligned with its mission and

objectives. Operational control, on the other hand, involves the

day-to-day management of the organization's operations to ensure they are

efficient and effective. In summary, strategic control deals with long-term

goals and direction while operational control deals with the current

performance and execution of tasks.

|

Strategic

Control |

Operational

Control |

|

Long-term

focus and goals |

Short-term

focus and specific tasks |

|

Top-level

management is responsible |

Middle/lower-level

management is responsible |

|

Broad

scope and strategic perspective |

Narrow

scope and operational perspective |

|

Evaluates

overall performance and progress towards long-term goals |

Monitors

day-to-day performance and progress towards specific tasks |

|

Looks

at external factors such as market trends and competition |

Looks

at internal factors such as resources and efficiency |

|

Uses

financial metrics such as return on investment and profitability |

Uses

operational metrics such as productivity and quality control |

|

Involves

making strategic decisions such as entering new markets or developing new

products |

Involves

implementing decisions made at higher levels, such as how to manufacture a

product efficiently |

|

Example:

Deciding to enter a new market or developing a new product |

Example:

Deciding how to manufacture a product efficiently or managing inventory

levels |

Key

differences between Strategic Control and Operational Control

Strategic

control focuses on the long-term goals and objectives of an organization, while

operational control focuses on the day-to-day management of the organization's

operations.

Strategic

control involves setting overall direction for the organization, while

operational control involves ensuring that the organization's operations are

executed efficiently and effectively.

Strategic

control involves making decisions at a higher level of management, while

operational control involves making decisions at a lower level of management.

Strategic

control involves monitoring the organization's external environment, while

operational control involves monitoring the organization's internal operations.

Strategic

control is typically the responsibility of top management, while operational

control is typically the responsibility of middle and lower management.

Strategic

control focuses on the overall performance of the organization, while

operational control focuses on the performance of specific departments or

functions.

Strategic

control involves making decisions about resource allocation, while operational

control involves managing the use of those resources.

Strategic

control is more forward-looking, while operational control is more focused on

the present.

Management

controls: The security controls that focus on the management of risk and the

management of information system security. Operational controls: The security

controls that are primarily implemented and executed by people.

What

Strategic Control does?

Steps

for Operational Control

- Set performance standards

- Measure actual performance

- Identify deviations (if any)

- Introduce corrective actions

The

focus of operational control is on the result of the strategic action, which

assesses the overall organization’s performance, different SBU’s and other

divisions and units.

Techniques

used for Operational Control

- Financial Techniques

- Network Techniques

- Management by Objectives

- Memorandum of Understanding

Financial

performance measures a firm's financial health based on assets,

liabilities, revenue, expenses, equity, and profitability. It is a thorough

analysis of company financial statements. Analysts examine a firm's Income

Statement, Cash Flow Statement, Balance Sheet, and Annual Report.

The

overall performance and position of the business should be evaluated based on a

set of criteria that includes liquidity, solvency, profitability,

financial efficiency, and repayment capacity. Each of these criteria measures a

different aspect of financial performance and/or position.

financial

performance measures an organization’s ability to manage finances. It is

evaluated based on a firm’s assets, liabilities, revenue, expenses, equity, and

profitability.

Financial

ratios serve as crucial indicators. It measures firms’ financial well-being

using data provided in financial statements.

Financial

performance metrics include quick ratio, current ratio, working capital, gross

profit margin, net profit margin, equity multiplier, debt-to-equity ratio,

return on equity, return on asset, total asset turnover, inventory turnover,

and operating cash flow.

Reduce

Costs

An

EPM suite can be costly, but considering all the data it brings together from

various departments in real time, its value is immense. Using modular solutions

with an open architecture gives you the same functionality, with the option to

integrate desired applications. You can view the per-project budget allocation

by connecting your budgeting and accounting systems with project management

software.

Upscaling

is easier with a single solution to learn. And automation drives efficient

workflows, saving resources, money and time.

Accelerates

Data Analysis

A

centralized interface gives access to unique, accurate and reliable data with

no risk of data duplication. Faster information retrieval translates to

speedier data analysis. Collaboration is possible through shared real-time

visualizations, team chats and comments. Having the latest data results at hand

gives you confidence in your decisions.

Data

science techniques like artificial intelligence and natural language processing

help identify patterns in multi-departmental data. Knowing what’s working and

what’s not can impact strategy restructuring and budgeting.

Improve

Reporting and Planning

EPM

software is an all-in-one budgeting, accounting and financial reporting system.

It has built-in standard reports like income and cash flow statements that help

you hit the ground running without IT help. Financial accounting software

allows you to track expenses and earnings, oversee payroll management and

keep tabs on goals and investments.

When

you know your business inside out, you can pinpoint how to improve it. Business

intelligence is still a part of most EPM offerings. Corporate planning is

easier with a clear picture of your core operations with their strengths and

weaknesses.

Boost

Efficiency

Automating

data aggregation saves time, letting you focus on performance analysis and

planning. Cloud-based software allows you to stay informed and perform tasks

remotely from any device. Create scripts to perform various tasks and automate

their execution using a scheduler.

Besides

scheduled uploads, administrators can automate reconciliation, profitability

and cost management, and financial close and consolidation workflows. Others

include data management, user provisioning and audit reporting.

Enhance

Customer Service

Designed

for your core operations, EPM provides robust back-end support to

customer-facing processes. Companies perform better with seamless supply

chain, inventory, and workforce management behind the scenes.

EPM highlights improvement areas and top-performing KPIs, bringing to the fore

your marketing, sales and customer processes for review and analysis.

Financial

Performance Analysis

Performance

analysis is the study of company financial statements —to discover a

firm’s strengths and weaknesses. It also involves the comparative analysis of a

company’s overall financial health. Company performance in a current fiscal

year is compared to previous periods and competitors’ performance.

The

different areas of financial performance analysis are as follows:

Profitability

Analysis: Owners, managers, investors, shareholders, and creditors use profitability

ratios. It helps determine a firm’s business performance and profit earning

ability.

Working

Capital Analysis: Analysts study firms’ operational efficiency to ensure that

the firm does not run out of current assets—required to meet short-term

obligations.

Activity

Analysis: This comprises the evaluation of a company’s production process,

human resource requirements, time taken, raw materials consumed, and

value creation. Activity analyses are undertaken to boost productivity and to

streamline business operations.

Financial

Structure Analysis: The interpretation of the business capital structure is

essential to balance the firm’s debt and equity proportion.

Indicators

The

financial performance of any business can be gauged through various financial

ratios that indicate a firm’s liquidity, profitability,

leverage, and market value.

Prominent

financial performance metrics are as follows:

1.

Gross Profit Margin: The ratio determines firms’ profitability before

considering the operating expenses. Its formula is as follows:

Ø

Gross

Profit Margin = [(Revenue – Cost of Goods Sold) / Revenue] × 100.

2.

Net Profit Margin: The net profit ratio is another financial

performance metric. It measures firms’ profitability after deducting all the

expenses from gross profits. It is evaluated as follows:

Ø

Net

Profit Margin = (Net Profit / Revenue) × 100.

3.

Return On Equity: It is a profitability measure that ascertains a firm’s

ability to generate profit from equity capital that was acquired from

the shareholders. It is represented by:

Ø

Return

on Equity = Net Profit / [(Beginning Equity + Ending Equity) / 2].

4.

Return On Asset: This profitability ratio determines a firm’s ability to

utilize assets efficiently to generate profits. Its formula is as follows:

Ø

Return

On Asset = Net Profit / [(Beginning Total Assets + Ending Total Assets) / 2].

5.

Quick Ratio: It is a liquidity metric; it analyzes firms’ ability to clear

short-term liabilities using cash and cash equivalents. Its formula is as

follows:

Ø

Quick

Ratio = (Current Assets – Inventory) / Current Liabilities.

6.

Current Ratio: It measures firms’ liquidity. It evaluates a firm’s ability to

pay off short-term liabilities (using current assets). It is determined as

follows:

Ø

Current

Ratio = Current Assets / Current Liabilities.

7.

Working Capital: It gives an overview of a company’s operational

liquidity—whether a firm is efficient in handling business operations. It

is evaluated as follows:

Ø

Working

Capital = Current Assets – Current Liabilities.

8.

Operating Cash Flow: Cash flow is a good indication of a firm’s

financial performance. This ratio analyzes a company’s efficiency in

maintaining a positive cash flow. This data can be acquired from companies’

cash flow statements—it can be positive or negative.

9.

Debt Asset Ratio: It is a leverage ratio; it measures a firm’s ability to

fulfill its short-term obligations, long-term obligations, and debts. This ratio

considers companies’ overall assets as the criteria. It is computed as follows:

Ø

Debt

Asset Ratio = Total Debt / Total Assets.

10.

Debt-To-Equity Ratio: It is a liquidity indicator; it is evaluated as the

proportion of external liability to internal equity. It is computed as

follows:

Ø

Debt-to-Equity

Ratio = Total Debt / Total Equity.

11.

Equity Multiplier: It is a proportion of assets to shareholders’ equity.

It indicates how much equity and debt was used to buy a particular asset. It is

represented by:

Ø

Leverage

= Total Assets / Total Equity.

12.

Total Asset Turnover: It measures the maximum net sales generated by

a business when it employs all its assets. It is computed as follows:

Ø

Total

Asset Turnover = Net Sales / Total Sales.

13.

Inventory Turnover: This ratio measures companies’ ability to convert stock

into sales:

Ø

Inventory

Turnover = Cost of Inventory Sold / Average Inventory.

14.

Accounts Receivable Turnover: It gauges firms’ efficiency in recovering

outstanding credit (sales) from the debtors. It is evaluated as follows:

Ø

Accounts

Receivable Turnover = Net Credit Sales / Average Accounts Receivables.

15.

Accounts Payable Turnover: This indicator evaluates a company’s ability to

repay creditors (goods purchased on credit). It is calculated as

follows:

Ø

Accounts

Payable Turnover = Net Credit Purchase / Average Accounts Payable.

Measures

of financial performance reduce a large amount of information into a convenient

form for analysis. No single measure of financial performance is adequate for

evaluating a farm business. Evaluation of several financial measures may be

more useful in directing the manager to ask the right questions than in

providing solutions to the financial problems of the business. Both the

magnitude of the measure and its relationship to other measures should be

evaluated.

Decisions

made in developing the balance sheet, cash flow statement, and income statement

have important impacts on the financial measures discussed in this OSU

Extension Fact Sheet. Some of those decisions include using cost or market

values in preparing the balance sheet; determining a specific value for each

asset and liability on the balance sheet; including or excluding accrued

expenses, deferred taxes, and personal assets and liabilities from the balance

sheet; estimating net income on a cash, accrual, or accrual adjusted basis; and

deciding if income should be before or after taxes. Each of these decisions

affects key relationships in the financial statements and impacts the financial

measures used to evaluate financial performance and position.

The

overall performance and position of the business should be evaluated based on a

set of criteria that includes liquidity, solvency, profitability, financial

efficiency, and repayment capacity. Each of these criteria measures a different

aspect of financial performance and/or position.

Liquidity

indicates the ability of the business to meet financial obligations when they

come due. Timely payment of the obligations of the business, including

principal and interest on debt without disrupting the normal operation, is an

indication the business is liquid.

Solvency

measures the ability of the firm to pay all debts if the assets of the business

are sold. Generally, if the market value of total assets exceeds existing debt

obligations against those assets, the business is solvent.

Profitability

is an indication of the level of income produced by the farm business and is

measured in terms of rates of return produced by the labor, management, and

capital of the business.

Financial

efficiency measures the degree of efficiency with which labor, management, and

capital are used in the business. Efficiency indicates the relationship between

inputs and outputs and can be measured in physical or financial terms.

Repayment

capacity measures the ability of the business to repay existing debt

commitments from farm and nonfarm income, and it is closely related to the

concept of liquidity.

Each of these criteria plays an important role in the analysis of financial performance and position of a business, and each has alternative measures that are discussed in this OSU Fact Sheet.

How

Does a Financial Controller Work?

A

financial controller takes care of an organization’s basic and advanced

financial activities. The person in charge plays a vital role in ensuring the

records’ accuracy is maintained. Controllers in a corporate firm are hired to

enhance the reliability of a business.

As

a business grows, the cash inflows and outflows are more frequent. Hence,

depending on bookkeepers for accurate records might be risky. Hiring a

controller to track the frequent transactions and check the records for

correctness becomes mandatory. These individuals ensure a company’s financial

documents are up to the mark and reliable for auditors to validate and

stakeholders to go through before making major decisions.

When

a company records a revenue of over $5 million, it is expected to

have a financial controller to control and supervise all basic and advanced

financial activities. The controllers are well aware of the generally

accepted accounting principles (GAAP) standards. Hence, they make sure

the financial statements generated by the companies meet the

requirements of investors and other stakeholders.

The

controllers participate in all kinds of business activities involving

financial expenditure. Besides the financial responsibilities handled, they

also take care of the insurance, information technology, sales tax

reporting, federal income tax reporting, human resources, and other

functions. In addition, these professionals also ensure managing the internal

controls so that the financial affairs are properly recorded and presented

for further decision making of the internal and external stakeholders of the

organizations.

Responsibilities

From

the roles that the controller plays, their duties are quite clear. However, a

set of financial controller responsibilities make their presence

mandatory for any organization. Let us have a look at some of them:

Example

Let

us consider the following example to understand the concept well:

A

small-scale company appoints Robert as the financial controller, acting as the

chief accounts officer. He has ten years of experience in accounting and

finance, and he is a Certified Public Accountant (CPA).

As

a controller, he is expected to manage all the finance and accounting

functions, including generating income statements, cash flow

statements, framing accounting policies, deciding the budget, etc. The

company assigns him tasks to distribute among an allotted team of 10 executives.

Robert joins the office and undertakes all tasks. He begins monitoring the

company’s financial statements as prepared and other duties allocated to him.

Investors

then use these financial statements to decide whether to invest in the

company’s assets, and auditors utilize them to check and validate the cash

inflows and outflows of the organization. In addition, he ensures getting

timely information from those departments so that his department’s work runs

smoothly.

Non-financial

performance measure that aligns with churn and retention rates. Businesses

typically measure customer experience by looking at all the business areas

where a customer directly interacts with the company, such as a customer

support team.

Significance of

non-financial performance measures

Financial

measures tend to focus on indicators that look into past performance, making

them relatively easy to analyze. Despite this, they often lack context, such as

why performance fell over a certain period. Non-financial performance measures

help add context to this analysis. For example, if the marketing resources fall

short in one quarter, the next quarter might experience a drop in sales. The

other main reason why non-financial measures are crucial for businesses is that

you can align them with certain parts of a business's strategy. It's unlikely

for an organization to include a mission or vision statement that focuses on

financial measures. Instead, they tend to align with things like best branding

and this might be challenging to equate to fiscal indicators. Non-financial

measurements, such as brand awareness figures, are much more useful in this

regard.

Benefits

of tracking non-financial performance measures

Although

financial measures are usually vital for a company to be aware of to understand

their performance, non-financial measures provide several benefits that help

companies measure their performance with additional context and fidelity. Some

of the main benefits associated with tracking non-financial performance

measures include:

Determines

strengths and weaknesses: By looking at these metrics, companies can gain

a greater awareness of their strengths and weaknesses. For example, certain

aspects of customer service, such as long hold times, are easier to identify by

using non-financial performance measures.

Tracks

business performance: One of the main benefits of using non-financial

performance measures is that they help track business performance. For

instance, if the HR team overspends, these metrics track this issue and may highlight

high staff turnover rates as the cause.

Improves

staff feedback: These measures are also a great way of guiding staff to

achieve success and align with the business's overall strategy. By using these

metrics, staff gain the opportunity to receive feedback that tells them what

targets to meet to succeed in their roles.

Adjusts

for external factors: Non-financial performance measures also consider

external risks, such as market volatility or unforeseen global events. Due to

this, using these metrics allow companies to gain a clear overview of their

performance, with any external factors included in this outlook.

15

Examples of Non-Financial Performance Measures

Taking

the Balanced Scorecard approach, there are four perspectives involved in

strategy management: customer, internal processes (operations), learning and

growth (HR), and financial. Below are 15 examples of performance KPIs,

organized by the three non-financial perspectives:

Customers

- Conversion Rate: The percentage of

interactions that result in a sale. Formula: (Interactions with Completed

Transactions) / (Total Sales Interactions) = (Conversion Rate)

- Retention Rate: The portion of consumers

who remain customers for an entire reporting period. Formula: (Customers

Lost in a Given Period) / (Number of Customers at the Start of a Period) =

(Customer Retention Rate)

- Contact Volume By Channel: The number of

support requests by phone and email. This allows the organization to not

only compare which method customers prefer, but also to track the number

of support requests month-to-month.

- Customer Satisfaction Index: Gauge of a

company’s success at meeting customers’ needs.

- Net Promoter Score: The likelihood that

customers will recommend a brand to others. A score from 1-10 that

qualifies promoters (usually 9-10) and detractors (under 6).

- Formula: (Number of Promoters) - (Number of

Detractors) = (Net Promoter Score)

- Customer Support Tickets: The number of

new tickets, the number of resolved tickets, and resolution time.

- Product Defect Percentage: This will give

you the percentage of defective products in a specified timeframe.

Formula: (Number of Defective Units in a Given Period) / (Total Number of

Units Produced in a Given Period) = (Product Defect Percentage)

- On-Time Rate: The percentage of time products

were delivered promptly as scheduled. Formula: (Number of On-Time Units in

a Given Period) / (Total Number of Units Shipped in a Given Period) =

(On-Time Rate)

- Efficiency Measure: Efficiency can be

measured differently in every industry, so this common KPI will vary. For

example, the manufacturing industry can measure efficiency by analyzing

how many units are produced every hour and the plant’s uptime percentage.

- Overdue Project Percentage: The number of

projects that are late or behind schedule. This can be pulled from

your project status dashboard. Formula: (Number of Overdue

Projects in a Given Period) / (Total Number of Projects in a Given Period)

= (Overdue Project Percentage)

Learning

& Growth

- Salary Competitiveness Ratio (SCR): The

competitiveness of compensation options. Formula: (Average Company Salary)

/ (Average Salary Offered from Competitors (or Average Salary Offered by

Industry)) = (SCR).

- Employee Productivity Rate: Workforce

efficiency measured over time. Formula: (Total Company Revenue) / (Total

Number of Employees) = (Employee Productivity Rate).

- Turnover Rate For Highest Performers: The

success of retention efforts for top performers and plans for talent

replacement. Formula: (Number of High Performers Who Departed in Past

Year) / (Total High Performers Identified) = (High Performer Turnover

Rate).

- Average Time To Hire: The efficiency of

the hiring process measured by time to recruit, interview, and hire.

- Internal Promotion Rate: The successful

retention and growth of top performers. (The Number of Promoted

Individuals) / (Total Number of Employees) = (Internal Promotion Rate).

Remember

to track the non-performance measures that best fit your organization’s needs.

There are hundreds of KPIs to choose from—focus on the ones that make the most

sense for your strategy.

Nonfinancial

Performance Measures: The Balanced Scorecard

Question:

Although financial measures are important for evaluation purposes, many

organizations use a mix of financial and nonfinancial measures to evaluate

performance. For example, airlines track on-time arrival percentages carefully,

and delivery companies like Federal Express (FedEx) and United

Parcel Service (UPS) monitor percentages of on-time deliveries. The

balanced scorecard uses several alternative measures to evaluate

performance. What is a balanced scorecard and how does it help companies

to evaluate performance?

Answer:

The balanced scorecard is a balanced set of measures that

organizations use to motivate employees and evaluate performance. These

measures are typically separated into four perspectives outlined in the

following. (Dr. Robert S. Kaplan and Dr. David P. Norton created the balanced

scorecard, and it is actively promoted through their company, Balanced

Scorecard Collaborative.

- Financial. Measures that shareholders,

creditors, and other stakeholders use to evaluate financial performance.

- Internal business process. Measures that

management uses to evaluate efficiency of existing business processes.

- Learning and growth. Measures that

management uses to evaluate effectiveness of employee training.

- Customer. Measures that management uses

to evaluate whether the organization is meeting customer expectations.

The

goal is to link these four perspectives to the company’s strategies and goals.

For example, a high percentage of on-time arrivals is likely an important goal

from the perspective of the customer of an airline. A high percentage

of defect-free computer chips is likely an important goal from

the internal business process perspective of a computer chip maker. A

high number of continuing education hours is likely an important goal from

the learning and growth perspective for tax personnel at an

accounting firm. Measures from a financial perspective were covered

earlier in this chapter.

Companies

that use the balanced scorecard typically establish several measures for each

perspective. "Balanced Scorecard Measures" lists several

examples of these measures.

Table

13.4 Balanced Scorecard Measures

|

Financial |

Internal

Business Process |

Learning

and Growth |

Customer |

|

Gross

margin ratio |

Defect-free

rate |

Hours

of employee training |

Customer

satisfaction (survey) |

|

Return

on assets |

Customer

response time |

Employee

satisfaction (survey) |

Number

of customer complaints |

|

Receivables

turnover |

Capacity

utilization |

Employee

turnover |

Market

share |

|

Inventory

turnover |

New

product development time |

Number

of employee accidents |

Number

of returned products |

Measures

established across the four perspectives of the balanced scorecard are linked

in a way that motivates employees to achieve company goals. For example, if the

company wants to increase the defect-free rate and reduce product returns,

effective employee training and low employee turnover will help in achieving

this goal. The idea is to establish company goals first, then create measures

that motivate employees to reach company goals.

KEY

TAKEAWAY

Most

organizations use a mix of financial and nonfinancial measures to evaluate

performance. The balanced scorecard approach uses a balanced set of measures

separated into four perspectives—financial, internal business process, learning

and growth, and customer. The last three perspectives tend to include

nonfinancial measures, such as hours of employee training or number of customer

complaints, to evaluate performance. The goal is to link financial and

nonfinancial measures to the company’s strategies and goals.

REVIEW

PROBLEM

Assume

Chicken Deluxe, the fast-food restaurant franchise featured in this chapter,

uses a balanced scorecard. Provide at least two examples of measures that

Chicken Deluxe might use for each of the following perspectives of the balanced

scorecard:

Financial

Internal

business process

Learning

and growth

Customer

Solution

to Review Problem

Answers

will vary. Several examples of financial measures are as follows:

Gross

margin ratio

Profit

margin ratio

Return

on assets

Receivables

turnover

Inventory

turnover

Answers

will vary. Several examples of internal business process measures are as

follows:

Capacity

utilization

Amount

of food spoilage

Order

response time

Answers

will vary. Several examples of learning and growth measures are as follows:

Hours

of employee training

Employee

satisfaction

Employee

turnover

Number

of employee accidents

Answers

will vary. Several examples of customer perspective measures are as follows:

Customer

satisfaction

Number

of customer complaints

Market

share

Amount

of food returned

Questions

1.

Relevant Questions for Strategic Control

- Is the premises created at the time of

formulation of strategy proving to be correct?

- Is the implementation of strategy is done

properly?

- Is there any requirement for change in the

strategy? If the answer is yes, what sort of change is needed which

guarantees strategic effectiveness?

- Relevant Questions for Operational Control

- How is the performance of the organization?

- Are the resources of the organizations being

utilized in an optimum manner?

- What actions are required to be taken which

confirm appropriate utilization of the resources so as to meet the

objectives of the organization?

2. How to evaluate the financial performance of

a company?

- The

following indicators are used to evaluate a firm’s performance:

1. Quick Ratio

2. Current Ratio

3. Working Capital

4. Gross Profit Margin

5. Net Profit Margin

6. Equity Multiplier

7. Debt-to-Equity Ratio

8. Return on Equity

9. Return on Asset

10. Total Asset Turnover

11. Inventory Turnover

12. Operating Cash Flow

How to improve

the financial performance of a company?

A firm’s financial performance can be improved by

implementing the following steps:

1. Sell off obsolete or unnecessary assets.

2. Improve cash inflows by speeding debt recovery.

3. Gradually reduce debts—to enhance debt-to-equity ratios.

4. Enhance profitability by eliminating unnecessary expenses.

5. Ensure proper inventory management—to reduce wastage.

6. Maintain sufficient working capital—for timely fulfillment of obligations.

Why

is financial performance important for organizations?

Investors

and shareholders go through the statement that depicts the firm’s financial

performance. They ascertain a firm’s financial health and profitability before

investing. In addition, business owners and managers use this analysis to

improve the financial condition of a firm.

Questions

1.

What

is trend analysis? Explain how the percent change from one period to the next

is calculated.

2.

What

is common-size analysis? How is common-size analysis information used?

3.

Explain

the difference between trend analysis and common-size analysis.

4.

Name

the ratios used to evaluate profitability. Explain what the statement “evaluate

profitability” means.

5.

Coca-Cola’s return

on assets was 19.4 percent, and return on common shareholders’ equity was 41.7

percent. Briefly explain why these two percentages are different.

6.

Coca-Cola had

earnings per share of $5.12, and PepsiCo had earnings per share of

$3.97. Is it accurate to conclude PepsiCo was more profitable?

Explain your reasoning.

7.

Name

the ratios used to evaluate short-term liquidity. Explain what the statement

“evaluate short-term liquidity” means.

8.

Explain

the difference between the current ratio and the quick ratio.

9.

Coca-Cola had

an inventory turnover ratio of 5.07 times (every 71.99 days),

and PepsiCo had an inventory turnover ratio of 8.87 times (every

41.15 days). Which company had the best inventory turnover? Explain your reasoning.

10. Name the ratios

used to evaluate long-term solvency. Explain what the term “long-term solvency”

means.

11. Name the

measures used to determine and evaluate the market value of a company. Briefly

describe the meaning of each measure.

12. What is the

balanced scorecard? Briefly describe the four perspectives of the balanced

scorecard.

What

is Transfer Pricing?

Transfer pricing refers to the prices of goods and services that are

exchanged between companies under common control. For example, if a subsidiary

company sells goods or renders services to its holding company or a sister

company, the price charged is referred to as the transfer price

Example

Consider

ABC Co., a U.S.-based pen company manufacturing pens at a cost of 10 cents each

in the U.S. ABC Co.’s subsidiary in Canada, XYZ Co., sells the pens to Canadian

customers at $1 per pen and spends 10 cents per pen on marketing and

distribution. The group’s total profit amounts to 80 cents per pen.

Now,

ABC Co. will charge a transfer price of between 20 cents and 80 cents per pen

to its subsidiary. In the absence of transfer price regulations, ABC Co. will

identify where tax rates are lowest and seek to put more profit in that

country. Thus, if U.S. tax rates are higher than Canadian tax rates, the

company is likely to assign the lowest possible transfer price to the sale of

pens to XYZ Co.

Arm’s

Length Principle

Article

9 of the OECD Model Tax Convention describes the rules for the Arm’s Length

Principle. It states that transfer prices between two commonly controlled

entities must be treated as if they are two independent entities, and therefore

negotiate at arm’s length.

The

Arm’s Length Principle is based on real markets and provides a single

international standard of tax computation, which enables various governments to

collect their share of taxes and at the same time creates enough provisions for

MNCs to avoid double taxation.

Case

Study: How Google Uses Transfer Pricing

Google

runs a regional headquarters in Singapore and a subsidiary in Australia. The Australian

subsidiary provides sales and marketing support services to users and

Australian companies. The Australian subsidiary also provides research services

to Google worldwide. In FY 2012-13, Google Australia earned around $46 million

as profit on revenues of $358 million. The corporate tax payment was estimated

at AU$7.1 million, after claiming a tax credit of $4.5 million.

When

asked about why Google did not pay more taxes in Australia, Ms. Maile Carnegie,

the former chief of Google Australia, replied that Singapore’s share in taxes

was already paid in the country where they were headquartered. Google reported

total tax payments of US $3.3 billion against revenues of $66 billion. The

effective tax rates come to 19%, which is less than the statutory corporate tax

rate of 35% in the US.

Benefits

of Transfer Pricing

Transfer

pricing helps in reducing duty costs by shipping goods into countries with high

tariff rates by using low transfer prices so that the duty base of such

transactions is lowered.

Reducing

income and corporate taxes in high tax countries by overpricing goods that are

transferred to countries with lower tax rates helps companies obtain higher

profit margins.

Risks

There

can be disagreements within the divisions of an organization regarding the

policies on pricing and transfer.

Lots

of additional costs are incurred in terms of time and manpower required in

executing transfer prices and maintaining a proper accounting system to support

them. Transfer pricing is a very complicated and time-consuming methodology.

It

gets difficult to establish prices for intangible items such as services

rendered, which are not sold externally.

Sellers

and buyers perform different functions and, thus, assume different types of

risks. For instance, the seller may refuse to provide a warranty for the

product. But the price paid by the buyer would be affected by the difference.

The

objective of a transfer pricing policy

The

objective of transfer pricing policies is two-fold:

1.

Harmony. Ensure that everyone in the firm is “on the same page” when it comes

to the transfer pricing arrangements. Successful implementation of transfer

pricing only works if there is “buy-in” from stakeholders. Before becoming

reality, it needs to be understood.

Example I: The finance

department wants to know what amounts to charge to which group entity (and

when), the risk department wants to ensure that transfer pricing arrangements

do not create risks, and the manager wants to know whether his/her financial

results are affected.

2.

Compliance. Demonstrate towards tax authorities that transfer pricing has been

considered and implemented the right way. It shows a proactive attitude which

is highly appreciated by tax authorities. It sets you apart from the crowd.

Example II: During a tax

audit, tax authorities normally check whether compliance / documentation

requirements are met. Besides showing the customary 100-page transfer pricing

report, it is powerful if a MNE can show exactly how the transfer pricing

arrangements have been implemented and are being complied with.

Example III: Added Value of

a Transfer Pricing Policy

If

you’re not convinced that a transfer pricing policy adds significant value to

your transfer pricing strategy, please read the following example (based on a

real case):

Teddy

Transportation (a global distribution firm) has invested significant time and

money in the preparation of a transfer pricing analysis and rock-solid

documentation. Further, the required intercompany agreements are in place. In

practice, not much follow-up has been done. Moreover, there is no (formal)

transfer pricing policy. Teddy Transportation operates this way for a couple of

years.

One

day the tax authorities knock on the door. They inquire about the transfer

pricing of Teddy Transportation. Teddy Transportation proudly shows them the

rock-solid documentation and intercompany agreements. Next, the tax authorities

check the books of various associated enterprises. They discover the following:

The

finance department has issued invoices for Intercompany support services for

amounts higher than they should be according to the transfer pricing

documentation and intercompany agreements.

There

are discrepancies between what is described in the transfer pricing

documentation and the actual behavior of associated enterprises. For example,

the documentation states that there are one Principal entity and several

Low-Risk Distributor (LRD) entities. Under this model, the LRD entities do not

assume much risk and do not get involved in marketing, price-setting, etc. In

practice, however, the “LRD entities” are assuming (much) more risks and

functions. They may very well be considered “Full-Fledged Distributors!”

Two

group entities have concluded an intercompany loan that the tax department did

not know of. Thus, it wasn’t included in any transfer pricing documentation.

Based

on these findings, the tax authorities are not convinced that Teddy

Transportation complies with transfer pricing rules. It starts an investigation

to verify:

whether

the allocation of risks, assets and functions on which the transfer pricing has

been based is in line with reality (actual behavior)

whether

there is transfer pricing documentation for all intercompany transactions.

The

above could have been avoided if Teddy Transportation had clearly laid down the

transfer pricing policies. Everyone should have had clarity on matters such as

what amount to invoice, how to invoice, how to book the transactions, how to

stay within the functionality borders of the Principal/LRD model, and who to

inform when a new intercompany loan arrangement is put in place.

Unfortunately,

Teddy Transportation now must spend time and money to address this. Resulting

potentially in more taxes and penalties if the tax authorities decide to make

adjustments to the transfer pricing…

How

to prepare a Transfer Pricing Policy?

It

goes beyond the scope of this article to discuss in detail what needs to be

included in a transfer pricing policy, however, in general, we advise to

include the following elements:

Transfer Price =

Outlay Cost + Opportunity Cost

For example, consider a division that makes hats. The cost of making one hat is

$2. That division can sell the hat in the marketplace for the market price of

$5. Therefore, the opportunity cost of selling the hat internally

instead of externally is $3. The transfer price would then be $5.

$5 = $2 + $3

In this simple example the transfer price is the same as the market price.

In more complex examples this might not be the case. However, transfer prices are

frequently based on or similar to market prices.

How

does transfer pricing work?

Transfer

pricing is a way of setting prices for transactions within a company or a group

of companies under the same management or ownership. This applies to both

international and domestic transactions. A transfer price is the amount that

one division or subsidiary charges from another for a product or service they

provide. Transfer prices are usually based on the market price for the product

or service. Transfer pricing can also be used for research, patents, or

royalties. Multinational companies can legally use transfer pricing to allocate

their profits among their parent and subsidiary entities.

However,

some companies may also use (or abuse) this method to manipulate their

corporate income and lower their overall taxes. Transfer pricing helps

companies to shift tax liabilities to low-tax jurisdictions.

Example

of Transfer Pricing: ABC and CBD are both subsidiaries of XYZ's company.

ABC manufactures cars and imports the engine from CBD. The price that ABC pays

to CBD for the engine is the transfer price. Transfer pricing can affect the

profitability and tax liability of each subsidiary and the parent company. If

CBD charges a lower price, then the revenue of CBD will be lower; on the other

hand, the cost of the car for ABC is lower, increasing the company’s profit. In

short, Company CBD’s revenues are lower by the same amount as Company ABC’s

cost savings—so there's no financial impact on the parent company.

Suppose

company CBD operates in a higher tax rate country; XYZ can save taxes by making

CBD less profitable and ABC more profitable. In other words, company CBD’s

decision not to charge market pricing to company ABC allows the parent company

to save taxes.

What

are the methods of transfer pricing?

Section

92C(1) prescribed the methods of arm’s length, which are the followings:

CUP

(Comparable Uncontrolled Price Method): This method compares the price

charged in a controlled transaction (between related parties) with the price

charged in a comparable uncontrolled transaction (between independent parties)

under similar circumstances. It is price for identical or nearly identical

property traded between the two independent parties under the same or similar

circumstance. This method is favored when there is a high degree of

comparability between the transactions and the markets.

Resale

Price Method: This method compares the gross margin obtained by a reseller

in a controlled transaction (between related parties) with the gross margin

earned by a comparable reseller in an uncontrolled transaction (between

independent parties) under similar circumstances. This method is suitable when

the reseller/distributor does not add much value to the product and acts as an

intermediary.

In

this method the price at which the product or services are resold or provided

to an unrelated party is identified. After adjusting gross profit margin and

other expenses from resale value, the resulting amount is considered as arm

length price.

Cost

Plus Method: This method compares the mark-up on costs obtained by a

supplier in a controlled transaction (between related parties) with the mark-up

on costs earned by a comparable supplier in an uncontrolled transaction

(between independent parties) under similar circumstances. This method is

appropriate when the supplier provides goods or services that are not highly

customized or complex and does not assume significant risks.

Profit

Split Method: This method allocates the combined profit or loss from a

controlled transaction (between related parties) among the participants based

on their relative contributions to the value creation. This method is

applicable when the participants are highly integrated and interdependent and

share significant risks and intangible assets.

(TNMM)

Transactional Net Margin Method: This method compares the net profit

margin earned by a tested party in a controlled transaction (between related

parties) with the net profit margin earned by a comparable party in an

uncontrolled transaction (between independent parties) under similar

circumstances. This method is useful when comparability is needed at the

transaction level or when multiple transactions must be aggregated

What

do you mean by capital expenditure control?

Periodical

totals of the capital expenditures incurred are made in the Capital Expenditure

Project Sheet to have a continuous control over expenditure. The progress of

the expenditure incurred on a project is reported from time to time to the

management through Capital Expenditure Progress Statement.

Objectives

of Control of Capital Expenditure:

The

following are the main objectives of control of capital expenditure:

(1)

To make an estimate of capital expenditure and to see that the total cash

outlay is within the financial resources of the enterprise.

(2)

To ensure timely cash inflows for the projects so that non-availability of cash

may not be a problem in the implementation of the project.

(3)

To ensure that all capital expenditure is properly sanctioned.

(4)

To properly co-ordinate the projects of various departments.

(5)

To fix priorities among various projects and ensure their follow up.

(6)

To compare periodically actual expenditures with the budgeted or.es so as to

avoid any excess expenditure.

(7)

To measure the performance of the project.

(8)

To ensure that sufficient amount of capital expenditure is incurred to keep

pace with the rapid technological developments.

(9)

To prevent over-expansion.

Steps

Involved in the Control of Capital Expenditure:

The

various steps involved in the control of capital expenditure are:

(a)

Preparation of capital expenditure budget.

(b)

Proper authorization of capital expenditure.

(c)

Recording and control of expenditure.

(d)

Evaluation of performance of the project.

(a)

Preparation of Capital Expenditure Budget:

The

first step in the control of capital expenditure is to prepare a capital

expenditure budget. The budget lays down the amount of estimated expenditure to

be incurred on fixed assets during the budget period. As the amount involved in

capital expenditure is usually high this requires careful attention of the top

management.

The

budget is based upon the annual forecasts of capital expenditure of various

divisions or departments. Each division or department of an organisation sends

the annual forecast of capital expenditure of its own department to Capital

Expenditure Sanction Committee. The Committee after considering the

profitability of the capital expenditure sanctions the expenditure and then the

amount is incorporated in the budget.

(b)

Proper Authorization of Capital Expenditure:

Preparation

of a capital expenditure budget and incorporation of a particular project in

the budget does not itself authorize to go ahead with the implementation of the

project. A request for authority to spend the amount should further be made to

the Capital Expenditure Committee which may like to review the profitability of

the project in the changed circumstances to see:

(a)

Whether the project is as good as when budgeted?

(b)

Whether funds are available as budgeted? and

(c)

Whether any better alternative uses of funds have arisen since the approval of

the budget?

After

making a fresh review, the Committee approves the expenditure. Projects

involving only small amounts of expenditure may be approved by a senior manager

without referring to the Committee.

(c)

Recording and Control of Expenditure:

Once

a capital expenditure is duly sanctioned, a proper record of the capital

expenditure has to be made. The record of the capital expenditure is made on

the basis of the information contained in the Capital Expenditure Request and

Sanction Form. A Capital Project Sheet serially numbered is used for this

purpose and all the details of the sanctioned project are written up in the

Project Sheet.

Each

capital expenditure project is assigned a number to distinguish it from other